MTW Recap - 6.18

- Rishi Pahuja

- Jun 18, 2025

- 4 min read

Updated: Jul 1, 2025

Okay. Not proud that I didn't recap last Friday or the previous week. Less proud that I continued that lack of writing these last three days. My intention was to never trade without first setting my plan in stone here. And, to never finish a day without recapping how the day went.

I've learned it's very hard to recap the day much later than the next morning. I can only vaguely remember each trade. I have, however, been on a solid run.

As I look back at the trades and mindset since last Wednesday, I've been hyper aware of identifying the setup and justification on the 10m. You could ask, isn't that what I'm always supposed to do? Yes. But, actually doing it every time is easier said than done.

But this past week I did just that. Secondly, having that the proper and strong justification for entry, I was then more willing and able to 1. wait for S/R and 2. actually enter close to my SL. Or, if I did enter too early, with a strong thesis I did a great job of NOT stopping out until the thesis was actually disproven. In that respect, it didn't matter I entered too early, because I held through the drawdown, or even added to the position anyway.

This mindset shift and focus has led to solid performance. Fewer, better trades.

8 wins and 1 loss. The loss was below my max trade loss of 2% of the portfolio.

My EOD trades, risking a small percentage of the days profit only went 2 for 4, but a net detractor from overall performance.

Since last Wednesday morning the overall growth in the portfolio was 23.00%. I know it seems like I'm cherry picking (if I actually included the day before, growth would be 34.87%) , but I'm delineating last Wednesday morning as an inflection point because since then I've been trading the right way:

Slow, methodical plan development

Extreme patience on the 10m chart

A clear understanding of support and resistance

Zooming to lower time frames only once a setup has been ID'd

Waiting for a lower time frame setup near a SH or SL that justifies an entry for the HTF play

I don't typically like to focus on performance because it's truly my process that actually matters for long term consistency. I'm discussing it here now because it's a by product of my process.

In all trades the last 6 days I was confident in the high time frame direction and patient enough to wait for a low time frame divergence to enter.

The biggest key was waiting until after the trap move. Waiting long enough for it to feel obvious. Being ridiculously patient and in line with the higher time frame thesis.

Basically, actually doing what I've always said I'm going to do.

Today was a great example of having enough conviction to know I was early, and even despite oversizing the first scale in, I still added in the dip given we didn't break below my desired entry.

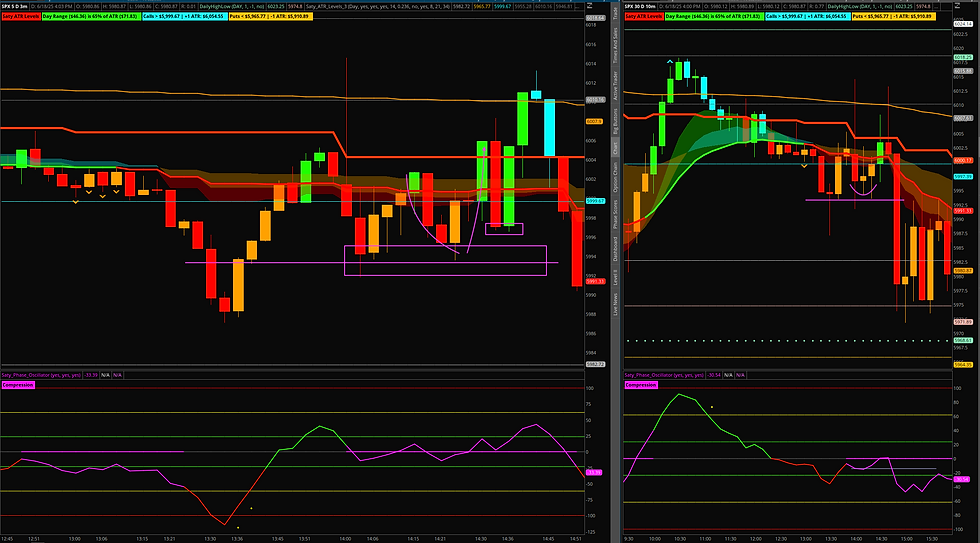

The 2p FOMC candle was very expectedly volatile with a ton of volume. While we put in a bearish candle that rejected the 200e and H21 we also help above the most recent 10m swing low. This was my first clue we had yet again found support. The next candle was clear in holding the 2p candle support. Near the end of the 10m candle is where I entered too early. I was concerned the move was going to happen with out me / fomo. But, I was aware of this and entered knowing that I would prefer to get in closer to the previous swing low.

Well I got my chance. We pretty quickly dipped hard down. Despite how scary that bearish engulfing candle was, I waited for confirmation on the next candle. This candle was unable to meaningfully break the prior candle low, nor the previous 1m swing low. This was enough justification to add to my position.

Now the one downside to getting in too early, especially with 0dtes. In a drawdown with size, I'm very quick to take profit. I essentially took the first half of the position off lower than my initial entry. So a loss on the first entry. Meanwhile we ripped 10 points very quickly from 5995 to 6005. I was able to exit with real profit on the 2nd half of the position, which more than compensated for the loss on the first half. Contracts ripped +40%.

I fully exited all but 1 con to hold as a runner. I'm not great at managing runners. On the one hand if instead of holding a runner, I just exited when I did my 2nd to last contract, I would've secured 31.7% MORE profit, on the other....

If I hadn't stopped myself out - which I did solely to protect profit, not because the PA suggested, then the contract would've hit 30% higher than my best exit. A return of 73% on that contract, and an additional 50% to the trades profit.

So it's not that the runner was a bad decision. It was that because it was in so much profit from a nominal standpoint, it's best to just take the profit, or fully and truly accept the loss and only stop out IF and only IF the initial entry support was breached. You can see in the smaller rectangle where I stopped myself out... it's above the support that gave the original justification to enter. The only reason to exit was a 3m close below the larger rectangle. However, because the nominal value was so high, I chose to protect profit instead.

I need to systematize when to leave a runner or not. Potentially a dollar gain per con? At that point I could roll up to a higher / cheaper strike or take the profit and put it into SPY cons.

Regardless a great great two weeks. Which is extra beneficial given I won't be able to trade for the next 2.5 weeks.

See you in July.

Comments