May 29 Recap

- Rishi Pahuja

- May 29, 2025

- 3 min read

Today tested me. Based on the hourly my bias was long, while also being cognizant of a very bearish 10m ribbon. We tested the ribbon and immediately tanked. Given my long bias I was tempted many, many times to enter at support. But, in every case I told myself to wait, because it was not obvious. And then it became obvious. I scaled in. I added. And profited.

More details!

Pre-market the 10m was solidly down, while my hourly bias was up. What I didn't notice is that the 920a candle was held down by the 10m200e. The 200e was acting as support at 7a, flipped bearish, and held as resistance at 8:30 GDP and again at 920a. It was also the 10m21e. While I don't fault myself for getting in there was enough justification. In the first 3m candle we tanked and while I was annoyed I didn't take puts, I remembered my system and plan suggested puts in the ribbon only, with the higher probability trade to be calls at support.

Once we started bouncing at premarket support, I very seriously considered taking calls. However, it wasn't obvious. I decided to wait until obvious. And, wait for the 10m candle to fully close. We got the 10m close and support held. And so I was thinking of entering. I then felt like I was going to miss my entry, but again decided to not catch the knife and instead wait for obvious.

I then proceeded to wait an additional 10m candle. This sent us down to the next level down at the call trigger. I was busy and 'annoyed' I missed the bounce up. Though there was still no actual concrete justification to get in, other than after the fact it worked.

This is where I was really tested. We got back to the ribbon and given the 10m ribbon and general direction I could've and should've entered puts at the hold of the 3m21e AND 10m8e. Again, my bias was up. I was so focused on calls. And, that's fine because I resisted entering calls until it was clear we found support.

Off the 3m21e, the 10a 10m candle was a high momentum push down. By 10:15a the 3m chart had created a morning star reversal with a horizontal support level of three wicks. Yet again I was tempted to go ahead and take calls. But, my setup is to wait, wait for a scary drop to breach that support and recapture with a hammer. And we got exactly that.

And even then I got in "early". Though it didn't matter because I felt strongly about my setup. I felt strongly about where I would be compelled to cut, and that I was extremely close to it. I scaled in at $22.80 and suffered a drawdown to only $21.9. After trying multiple times to break below I added more size.

Once we ripped to the previous swing lows low / 3m21e / 10m8e I exited most my position. I'm glad I did because for the next 15 minutes we chopped between my entry and my high exit.

While waiting through this chop I did become more confident we would go higher, while also being very cognizant that we were very much in a down trend. I held my final contract and exit at the previous 3m supply zone / 3m48e / 10m13e. This was a top ticked exit!

Learnings from today.

Even if I 'miss' it I haven't missed it

Even if there's a big move, it doesn't mean I should've been in it

Even if I 'know' where we're headed, if we're not at support or resistance I do not enter.

Waiting for obvious on the 10m is the only way.

Interestingly enough we eventually reached down to the hourly swing low I had marked in premarket.

I'd also like to point out how much potentially clearer my setup appeared on SPX vs SPY.

Basically a morning star reversal off the H21 back up to the supply zone. Later on the downside continuation was actually the clear trade. We had a second but lower attempt to break through the supply zone, only to lose the ribbon. Support held at the next candle, but the ribbon and call trigger held as resistance. That was enough justification to get in, with the call trigger as risk. That was the cleanest and most violent move of the day. Which reach the PDL.

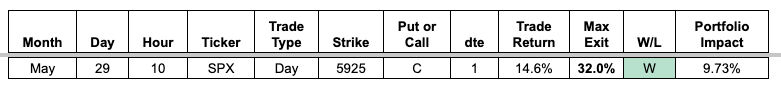

1 trade today. 10m chart. High conviction. Large size. Big return.

If I just ignore 'missing' it on the 10m and instead wait until it's actually obvious, I can return consistently. I will continue ignoring the missed move and instead wait for the easy move.

Comments