May 28 Running Thoughts

- Rishi Pahuja

- May 28, 2025

- 5 min read

Trying something different today. I'm going to write my analysis and plan. Then record my thoughts as I'm watching and waiting on the 10m chart.

Are we at support? Are we at resistance? Explain the setup.

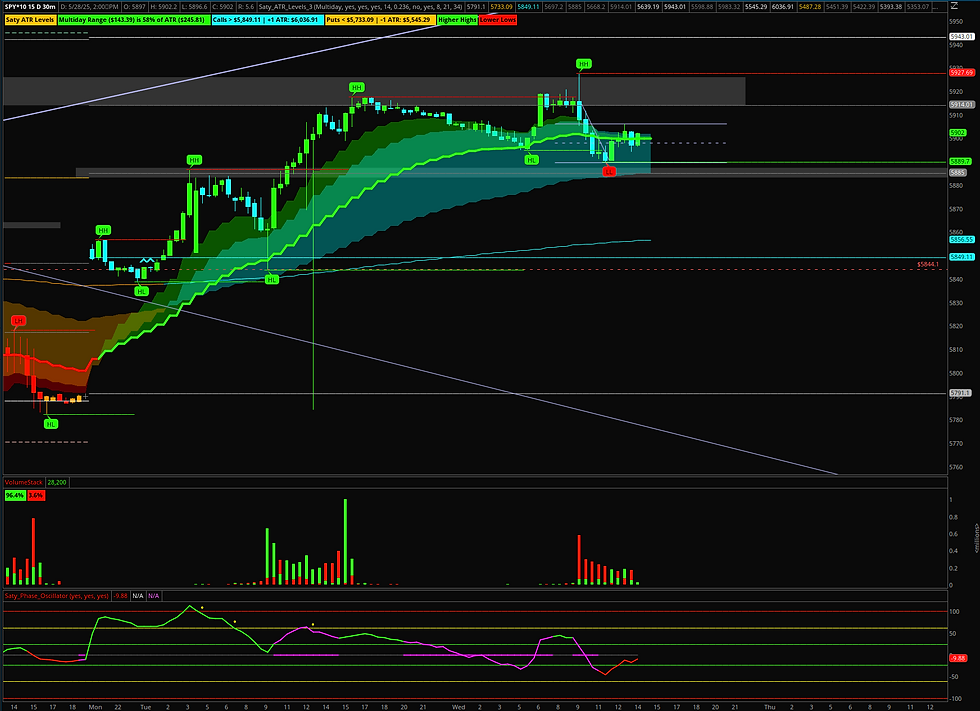

Hourly Chart

Structure and ribbon are bullish. The most recent HH was with a lower PO reading indicating some mean reversion which we've since achieved. This morning we tested the overnight swing low and have started to bounce from there. At 10a we lost the H21. 11/12/13 candles have all reached above but the 21e ultimately held as resistance. Bullish bias. We are currently much closer to the most recent 30m swing low than 30m swing high. Along with the bullish bias this favors calls at support! From an ATR standpoint, we've hit the MD 500 level, meaning it is more likely to continue up to the 618 and looks like the MD 382 is the support level.

The 10m Chart

Put in a LL. Ribbon is bearish but clear support at the Day put trigger. We could see a move back up to PDC or if the 10m48 continues to hold as resistance, perhaps another retest of the put trigger. While the hourly bias is up, the 10m is down. Rejections of the ribbon can retest support but there's no reason to hold or chase into puts because it's more likely to continue acting as support as opposed to breaking. So puts at 3m swing highs if the 10m continues to hold. If the 10m 48e is recaptured, that triggers an inverse vommy. Look to enter at a 3m swing low to ride price up to PDC. Size small. Buy time. Wait. Trust the system.

Running Thoughts

It feels like I'm going to miss the move up. BUT, we are far closer to resistance than we are support. So while it may rip, it's not a system entry. I'd prefer to wait for the close over the 10m48e to signal for upside.

We're also pretty range-y. Chopping between the put trigger and PDC. H21 horizontal. 10m emas sideways. So, we were closer to resistance so I compelled myself to look at puts even though I was just 'feeling' fomo on upside. Of course we're now tanking from resistance and 1dte ATM puts have already moved 10%.

I want to get into puts. I will wait at least 10mins even if I miss. Because I'm always early. And there's always another opportunity to get in. Also, the bias is up. Calls at support. We are now just back at support. Should I be getting into calls? Well what's the setup? Is there a setup? Where's my W with divergence off a key level?

I'm feeling the desire to get into something. But its not obvious. I will wait until obvious. Even if I miss the short term moves. Because it's the big 10m moves where I can size up in the long run, and in the short run, make plenty with small size, because the move will be larger.

Okay now I'm feeling like we're headed up because the 10m21e reclaimed. But 10m48e continues to be resistance. But hourly bias up. Basically, what I'm taking away from the constant flipping is that we're chopping with no prevailing direction. And / Or it's not obvious. So I don't need to worry about it anyway. It always becomes obvious. So I'll just wait.

Ugh. big move happened. Three minute reversal off the 10m48e with an inability to make a new high. I wanted to chase at $24. Then we absolutely tanked down to $37. I waited for a monster pullback and did end up getting in at $24. But, of course, the move down already happened. I stopped out. Then oversized into calls. For a flash I actually more than compensated for the initial loss but I wasn't fast enough taking profit. I managed to minimize the damage. But, damnit another day of just caving to the volatility.

Yes it was a massive move. Yes I missed it. So what. Save confidence and capital for the next trade. I get into this short term thinking where I feel like I have to make it now. But, I don't! What I need to do is let it go. Marvel in missing it. Maybe I missed it for a reason.

Like every time a big move happens I get down on myself for not having gotten it. When in reality, I probably shouldn't have been able to get it. It wasn't a system play. I missed moves all the times. All good. Whatever. It's all about compounding confidence and capital.

Of course now it feels a bit more obvious. Or maybe not. The hourly bias is still up. The yet the H21 is still acting as resistance. So hourly says up. 10m says sideways. But lean down. We are headed down.

The puts I originally bought at $24 are now..... back to $24. But I had stopped myself out at $21.. The low was $20. no we're at $25 and I believe going higher.

If I hadn't sized as I did, perhaps I wouldn't have stopped myself out. The size and loss compelled me to stop. I want to say not necessarily the PA. But yes the PA warranted getting out. But because it was such a large position, I lost confidence. I lost capital. And, wasn't in my right mind to execute the next trade. We're also at key psych level of 5900.

When I 'miss' the move. I have to remember that 1. whatever TIAAT. and 2. stay slow and calm because there is always another entry if I wait long enough.

Come. On. Man.

So far we're repeating last week. Two days of shit execution to start the week. Then buckle up, do it right, think I've got it. I'll never 'get it.' There's just doing it day in and day out.

Update.

3:30p. We def headed back to 5900. Puts are at $26. +7%.

3:37p. 5900. Puts at $28. +15%.

Scalp golden gate open with 5880 target.

5900 0dte at $4.5 at 3:40p. Hit $7.8 3:41p. $10 at previous LOD at 3:51. $18 at 5880!

5880s went 13x.

3:41. 5895 hit. Puts at 31. +27%

3:50 Previous LOD hits. Puts at 32. +32%

3:54. 3m200 SPX $38. +56%

Are we at support? Are we at resistance? Explain the setup. Size properly. That's it.

The hard part about waiting until it's obvious is not getting sucked in when a big move happens. I have to be okay missing a move and know that if I wait a clear setup and entry will emerge. And, small size into 1dte will pay. 24 to 38 is $1400/con.

When I briefly checked the charts after open I thought to myself man I missed a big move up. While yes the real move was the push higher into supply (big move up), tweezer top bearish engulfing and lass of 10m21 and PDC level. Those were enough justifications to take the downside down to the put trigger.

Then we got a giant move down after an evening star reversal off the 10m48e. It was fast and violent and I very much felt like I missed it. So I was incessant on grabbing the pullback. That was solid. But, rather than try to snipe the pullback, why not wait, wait, wait for a clear price pattern rejection. Which, eventually did come. A tweezer top emerge. Then a further move down with the 10m21e acting as resistance confirmed further downside. Additionally on scalp levels the 382 was tapped, triggering a 65% chance down to the -618. Which happened and paid off. My original puts that I stopped out at only 12% with a full drawdown just to -20% ultimately netted 55% or almost 100% from the drawdown.

Ignore the missed move. Wait for the 10m close. There's no such thing as missing anything.

Comments