May 20 Recap

- Rishi Pahuja

- May 20, 2025

- 5 min read

Updated: May 21, 2025

Another day of poor patience compounded with poor risk management.

The original plan called for "This would be a day to consider scalping only. Calls at support, puts at resistance, exit at the opposite. Or, wait for a high volume break of the put trigger for a continuation down"

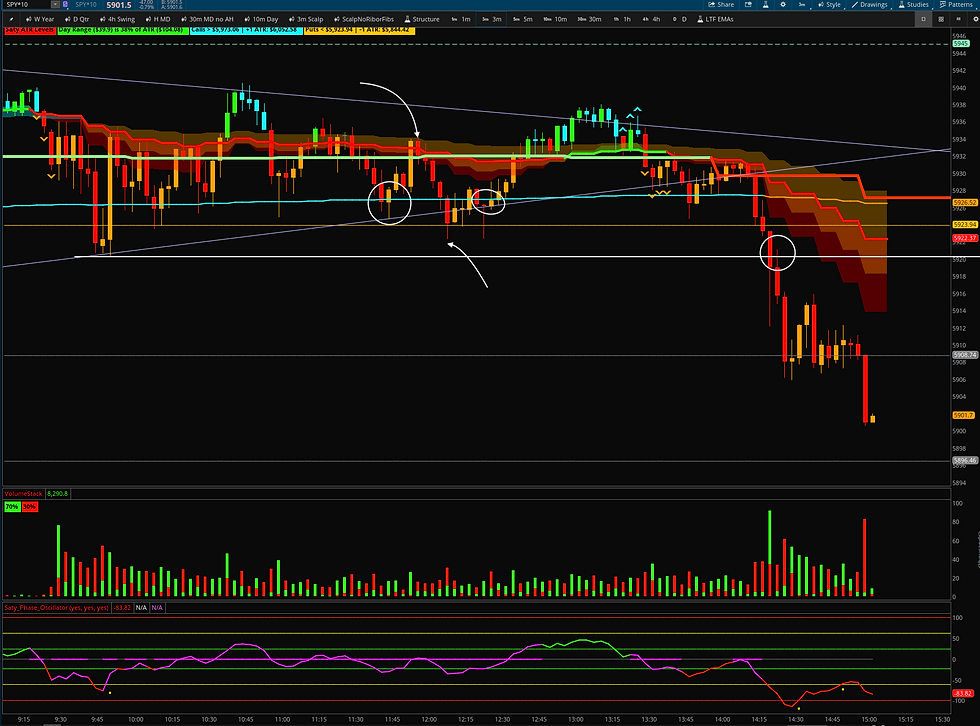

And, that's what we got. Severe chop with fake breakdowns at support and fake breakouts at resistance. All to reduce everyones mental and financial capital until the move we planned to wait for happens.

I said, scalp only, CASPAR, exit at the opposite...

I was extremely hesitant to get in at the put trigger despite knowing it had previously acted as support, despite knowing our bias was long, despite it being the put trigger! I did eventually get thinking that was the trap move down and that we'd breakout higher. This again despite saying to exit at the next level regardless.

So, what did I do...

The first circle. Price tried to break to the put trigger but on very low volume. I could've entered there. Then the next 3m candle, we pushed lower only to get swallowed up by bulls and create a tweezer bottom. That 2nd hold of support and tweezer bottom was also a valid entry. At that point I was ready to enter, but I wanted an entry closer to support. The next candle continued rising, yet I was still convicted in waiting for another test of support. Next candle drops but only back to the neck of the tweezer bottom. That was also a justifiable entry. I missed and then we had the explosive candle. I justified my entry that we saw a bounce off support and I could get in for continuation. However, I made it very clear that in this sideways action, its best to exit at the next level. Which the previous swing high / supply zone was just above my entry. Low risk / reward.

Because I had sized appropriately I was willing to wait for support to actually break before exiting. Willing and able are two different things. I was willing and waited for price to retest the put trigger, but at that point I was convinced we were going to break down and so exited my calls for a small and manageable loss. However, in the moment that loss hurt and I let that hurt emotion get the best of me. I entered puts...

As per my original plan, the put trigger was support and buyable. We got my favorite and classic setup off the put trigger with a W! ELs made just below the put trigger, with higher PO reading, plus the dragonfly doji.

That was also an acceptable entry for calls. It would've been slightly above where I stopped out and returned 25%. Instead I took a 12% loss stopping out very close to the low.

I bring this could've would've scenario because 1. it became so impossibly clear to me. A W off the put trigger with divergence and a very bullish candle! and 2. because even with that ideal entry, we were in range and so potential profit was only 25%.

That is in stark contrast to a a LATE entry into puts once the range was broken! I said this morning "wait for a high volume break of the put trigger for a continuation down" We got the break. Puts were at 17 in the ribbon. After the 3m confirmed the break, puts were at 24. Puts went to 32 at the next level down (33%), pulled back to a low of 26 before ripping to 39 (63% gain).

When I wait for a break of range then 1dte can pay 50%+. What I have been accomplishing the last 4 weeks is scalping smaller ranges of 20%.

I say this not to suggest I should hold positions but rather realize it's prudent to scalp / exit quick if trading within a range. OOOORRR wait for a break of range, and even if 'late' the move is more likely to be larger.

BTW, in the screenshot above we're putting in a lower low in price with a higher PO and divergence dots. A move to the 3m21e is likely and buyable.

Update: 40 delta 0dtes just went (3:06 pm) $2 to $7 (3:18pm) with a low of $1.85. As I typed. Clear, easy, just a matter of waiting and not having the pressure on so then it's easy to see it clearly.

Update 2: Hit $12 at 3:33pm. With the right setup and entry, tiny positions can yield large winners. $2 to $12 is a $1000 profit per contract...

Okay. So what's the learning from today.

I'd always been curious how Saty decides when he needs to absolutely wait for CASPAR vs entering in slightly away from support or resistance. I believe it has clicked today.

If and when I'm trading in a defined range it is incredibly important to enter at predetermined support and resistance. Why? 1. If I'm wrong, I lose less. 2. If I'm right, I'll profit enough even exiting at the next level - which is what I'm supposed to do when trading in range!

Where it's okay to get in "late" is when I've confirmed a breakout. Of course easier said than done because after any breakout is typically a retest before continuation. But, in this case we had been chopping for so long, and the 3m candle that confirmed the break was with very high volume. The confirmed breakdown of the LOD with significant volume was enough justification to enter puts 'late'

Doing or not doing all of these things does NOT matter though if I'm not sized appropriately...

I'm getting better at ensuring we're at support or resistance - though still hesitating.

I did not meet my challenge of scaling in 1 at a time..

I need to establish before the trade if we're in range or breaking out. Knowing which is incredibly important to establish an exit.

Though as I write this I realize the exit point is always the next level! If we're in a range then the next level is the previous swing high or low. And if we've broken out it's simply the next ATR level.

My entries are at swing pivots and ATRs. My exits are at swing pivots and ATRs.

The question then becomes is there a setup or not? I think I've established I'm best at identifying Ws with divergence off key levels. They are the easiest for me to ID. But, require extra patience!

2 days of poor execution. I will not take a trade tomorrow.

I took one more trade. The trade I called out while writing this: the 3m divergence with a move up to the ribbon. Well it ended at the 10m21e.. I waited for price to confirm resistance. Two 3m candles couldn't break the 21e also the scalp put trigger also this mornings support level and afternoon breakdown level. I was anticipating an M off that level. I went ahead and got in on the first side of the M and exiting at the next level down. Very quick, easy, effortless 25%.

It's once I'm not trying to trade that I see price so clearly.

Support. Resistance.

Risk. Management.

Range. Trend.

Comments