May 16 OPEX Plan

- Rishi Pahuja

- May 16, 2025

- 2 min read

It's been the theme all week. We're too extended to chase the rally up and the rally is too strong too short. So, we think shorter hold trades, take our points and GTFO. What I've done in the past is get chopped up in weeks like this, expend a lot of emotional and financial capital, only to burn through any confidence, just before the big move finally happens. And, that's frankly what the market is designed to do. Make sure the least amount of money participate in the real move. The market does this by trapping up and down until the liquidity is dried up and the next leg begins.

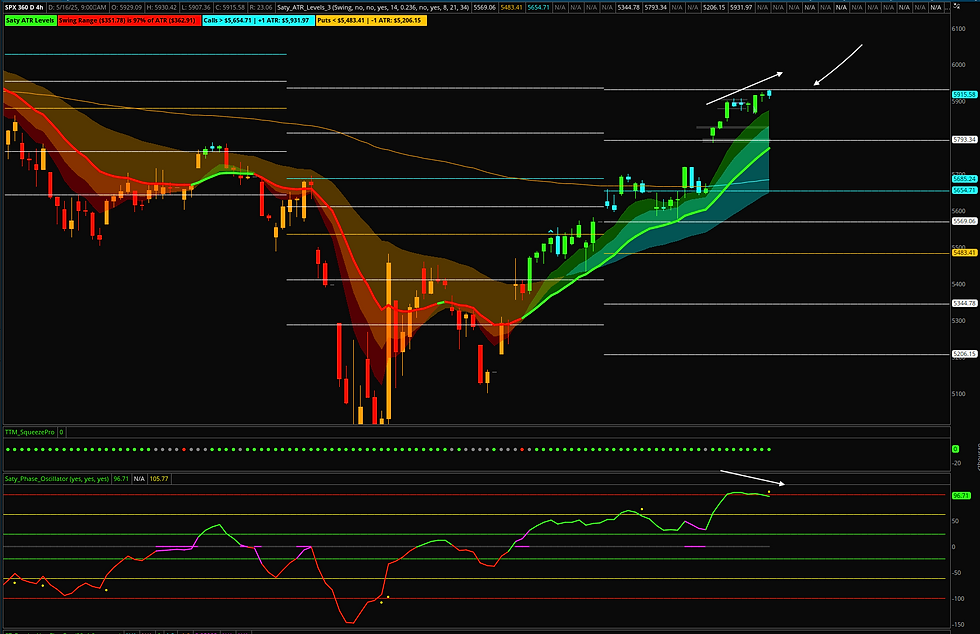

The 4h chart is very clearly bullish, but we've stalled right at the Monthly +1 ATR level. A very slight divergence is starting to form as we try to push slightly higher but with the PO starting to decline from an extreme reading.

The divergence on the hourly is far stronger making it less likely for any continuation. On the weekly levels we've already surpassed the full ATR move so that also suggest a lower probability of further continuation. Though the +1 level and H13 are currently acting as support. I will treat it as support until it actually breaks.

Today's Plan

Basically the same situation as yesterday. A very narrow range that I can scalp, calls at support, exit at resistance. Or puts at resistance, exit at support. That's what I did yesterday only to lament not waiting for the breakout and entering for more significant move.

Today I will continue to be laser focused on questioning where we currently are. At support? At resistance? Charts are bullish though extended. Supports support until they don't. I've had a solid week so I will be extra patient and wait for a clear breakout instead of scalping in range.

I mention OPEX because it is typically a very hard day to trade. Gamma exposures typically are meaningless because it's all about rolling positioning. And the volume tends to come in very tight ranges and it's important to be cautious of extremely trappy and choppy PA. Patience, as it always is, will be the most important factor for today.

Comments