May 12th Plan

- Rishi Pahuja

- May 12, 2025

- 5 min read

Reporting Additions

Before I get into the plan... I've thought a lot about what happened at the tail end of last week. Something was off and ultimately it comes down to wanting to make money by trading vs waiting for the system to signal a high probability setup. The clearest example of this was Friday when we were stuck in the trigger box. There's no better identifier of weak trend then moving sideways within the two triggers. I know from backtesting this is not an ideal trading environment. Yes, if I zoom into to shorter time frames I can find direction, but it is much harder and my propensity for expecting continuation gets in the way of proper exits given the shorter time frame.

I've also thought a lot about getting to a position where I feel confident raising money and can actually do so. This requires me to continue to focus on confidence in the system. Not concerning myself with the outcome of an individual trade, but rather the execution of the edge, the defensibility of the trade AND the position size.

Two additions to what I'll report on to help keep me in check and because I'm me, the pre (over) explanation of each factor.

When I think about where'd I'd like to get to in my trading execution, I think of someone named Assface... I know, hard to take seriously, but his ability to be so amazingly deferential to the price action, and not cave to emotions, is so great that he's able to hold highly volatile trades until the likely exit is actually hit. I believe this ultimately comes from having clear context of each trade he takes and therefore the likely outcome. More clearly, he's not just getting into a trade because the edge is present, theres also a justification for holding as long as he does. Eg. If we're extended on the hourly and there's divergence, we have justification for puts, but we also have justification to hold down to the H21! Where as currently I'm focused on taking profit to build the habit. That is certainly required first, but I want to build great habits now to end up in a position where I can size large enough to let a trade really run. But, not run from a just in case it runs stand point, but to let a trade run because I have conviction on the likely magnitude of the move. That is the long preamble to say that in my trade plans and recaps, I will highlight the higher time frame context to come up with a defensible price target.

More context around potential targets (ATR based on HTF context)

I believe I've been too overly focused on my win rate. It's certainly healthy and my profitability depends on a high win rate. However, the one factor that will ultimately keep me from growth, even with a high win rate, is outsized losses. If I'm too focused on win rate, then I subject myself to letting a loser get bigger in the hopes it becomes a winner. I've learned time and time again, its far better to either size smaller and/or take the loss anyway and allow myself to reenter the trade if the criteria are still there. While yes the win rate matters, what matters more is the actual impact on the portfolio. So, I will report on each trades impact on the P/L. That way its apparent when a loss is small and not to be penalized versus when a loss is huge and should be called out!

Report each trades contribution/detraction from the overall P/L. Limit big losses.

Revisiting my end of May call given last Monday

Welp, we've gapped up bigly. Clearly very bullish, but we're too extended to justify entering and the trend is too strong to consider shorting. It would've been real nice if I was swinging calls. I actually believe I'm better at swings because it requires an incredibly clear justification and plan to enter. With candles idle, it's easier to focus on what the price action is suggesting; it's easier to have more conviction in stop levels and price targets; it's easier to ignore intraday fluctuations.

I bring this up because last Monday I wrote "it's likely we hit 5800 by end of May. 5930 is Monthly +1 ATR and well within reason" I noted that May 30 5800Cs and May 30 5525Cs were $46 and $205 respectively. As of 130p today they're at $107 and $330. 100% and 65%.

I also said "This is certainly not the right place to get in, but with wide enough stops and confidence we can reach higher... it may not matter." The 5800c hit a low of 30 (a 33% drawdown) and the 5525C dipped to just 190, just a 7-5% drop. What I find difficult to overcome is that while these drops on percentage terms were very different, their per contract drawdown was $1500 in both cases. So, which is the right contact? Because if I am willing to stomach a $1500/con drawdown, I could've also gone with the monthly opex 5800Cs expiring May 15. These were $17 ($1700/con) dipped to $7 and currently at $60. More risk of losing the entire $1700, but relative to the first two strikes and days to expiration the same dollar drawdown.

5/5 Low % $ 5/12 % $

5800C May 30 $45 $30 -33% -$1500 $107 138% +$6200

5800C May 15 $17 $10 -41% -$700 $60 253% +$4300

5525C May 30 $205 $190 -7.5% -$1500 $330 61% +$12500

Per dollar of risk the 5525 May 30 Calls drive the highest return

Finally... Today's Plan

As I started to say before I got on my tangent about trading higher time frames.. We're crazy bullish today, likely too extended to enter calls, and too strong of a trend to want to enter puts. So like everyday we stay patient.

On the hourly chart we have clear bullish bias. The H13 was tested since open and held. We've so far started to reject this mornings high, but could simply be a pullback to the ribbon before continuation, especially because we're so extended on the higher time frames. We have 2 dots on the PO indicating a likely mean reversion down to the Hourly 21. That would be a pretty meaningful move, especially in the face of such a strong ribbon- however, 2 dots on the PO signal exactly that, an eventual date with the H21. This is where I think AF would hold til his target was met. This is the context that allows him to hold. Our system is very clear about a move to the H21.

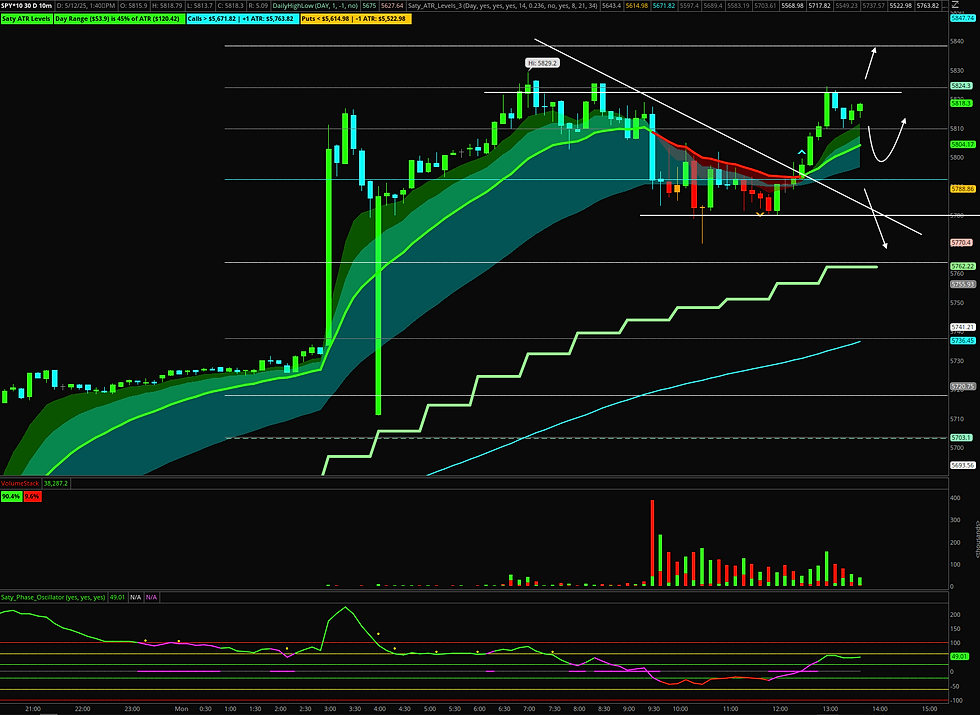

Down to the 10m..

Bull flag from premarket highs finally broke and price expanded out of the squeeze to tap the supply zone from the open. Classic continuation or vommy on the breakdown of the 48e, but because we're so extended on the hourly (and daily ATR levels) it is LESS likely to have an outsized move higher. It can happen with the trend being up, but it's a lower probability setup. But what's the setup to the downside? All I know is that if we break the day's high downside is proven wrong AND I don't need to enter until the 3/21 flips anyway- especially because I've considered an outsized move down given the likelihood of a move down to the H21 at +1 Daily ATR.

Plan. Bullish Bias. Calls at the 10m21e after a reversal pattern on the 3m OR if we reject the high AND the 3m21 flips we can enter puts down to the 10m21e then the 48, then 1.236 and +1 ATR.

I do not need to trade or make money. I do need to wait for a systematic entry. Success will be small red, green or no trade.

Comments