May 1 Recap

- Rishi Pahuja

- May 1, 2025

- 5 min read

Okay.. what did I miss. I feel like I followed the plan. I also followed the idea of missing the trade since I'm usually early, and even then I was early. So early in fact that almost two hours later now we're getting the move I expected!

My bias was long. I suggested a potential scalp put given the crucial 618 level was holding as resistance. I was reluctant to get short, because typically I want a 10m divergence. Which I didn't see. But, in the picture above, the divergence was there... The divergence, plus the tweezer top rejection of the 618 level plus an inability to reclaim the 3/21 were all great justifications for short.

I did not get short. I didn't chase short. Nor did I prematurely enter calls. So I thought!

Once price entered the grey box which marked the overnight resistance, turned support, turned resistance, turned support, I zoomed into the 3m and 1m chart to wait for a W entry. We got that on the 1, so I entered, albeit after confirmation. We ripped, but what I didn't factor in was the 10m lost the 48, pretty convincingly- which according to the plan was an area to then think short.

So I took a very small L on the trade because I let the runner turn the entire trade negative. In the end and 2 hours later, the contract low only went 5% lower before ripping past my profit targets.

Oh well. I managed risk. I stuck to the plan. I just missed something. That will happen, and it's fine to happen as long as I continue to manage risk.

What I am concerned with now though, is the original trade is playing out, but I got to my computer a tad late to enter. I'm already fighting the urge to get in. But, my system dictates to enter calls at support, and if that means I "miss" the trade, it is what it is. On to the next one.

The 10m on SPX was at the extreme zone as well, so another reason to be okay taking puts, given the other confluence.

Trade 2, and basically 3, and 4, and 5.

I never want to be in a place to take that many trades. There are just more and better opportunities out there. What kept me coming back, was that it was the same thesis. Yet, it was also the same error that had me stop out.

So trade 1 I entered calls too early. I walked away so as to not do anything rash. This was helpful because I likely would've gotten in on the 2nd test of the H21. But it took a 3rd test before really moving. This is where I got sucked back in. We started ripping off the support that I had essentially taken my stop on the first trade.

I was insistent that would we continue higher, and so rather than waiting for 10m support or even a 3m swing low, I looked to the 3m ema's to justify in entry. I entered at the first arrow, then added at the second arrow. BUT, AND THIS IS AN UNACCEPTABLE ERROR, I OVERSIZED. So, after my second entry, as price started to continue against me I just stopped myself out.

A few minutes later it's clear to me we were creating a higher swing low on the 3m and entered the trade again, buying back some of my original cons for more than I sold...

I was patient and exited the with a 22% gain. Unfortunately, because I oversized on the losing trade, 22% couldn't overcome the -15% on the losing trade.

The positive I'll take away is that in the moment I was reluctant to exit at 22% because I still believe we were headed higher, the thesis was still there, but we were at resistance, and I felt comfortable exiting knowing that it may run without me, or better yet, if we did pullback I could always get back in.

Which is exactly what I did.

Granted I got in a tad late. I exited most the position at the next level up, and then took my stop at breakeven, thinking we would continue higher.

Every time we stopped out, we moved lower which made me feel good about my exit, then we ripped off actual support and I enter, because I'm still convinced we're going to make the move higher. And, I don't want to miss that move higher when I've been 'waiting' for it all day.

In both cases we had a sharp move off of support and the I entered, counting on continuation. All of this is fine if I size appropriately, wait for clear invalidation of the trade and enter as close as possible to support.

I don't get in at support for two reasons. 1. I think it's already hit and I'm going to miss it 2. It does hit it again, but then I hesitate thinking I'm wrong. Hence I chase in because it already hit the support and it's going to go without me. And the cycle continues.

Very interestingly, today I traded the same contract over and over again. My average entry was $28, with the best entry at $26.4. My worst exit was 24.3 and the lowest it hit after that point was $24...

Getting in closer to that level and / or sizing smaller so that any wiggles below don't create a drawdown, I'd be fine. It's the risk management that gets me.

I lost 4% on the day. If I had sized the big losing trade properly, then I would've lost -.75% or even ended green .3%.

It's my sizing that gets in the way. Unless I'm going to buy perfectly at support or resistance, and if I'm going to continue to instead wait for confirmation, then I have to, have to, have to size appropriately.

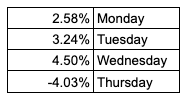

Tough day, but only drew down 4% on the port. For context the daily change in port for this week was:

I'm NOT going to report on this daily because I want to focus on the weekly return. I will continue to have red days. It's just incredibly important to keep those red days infrequent and small. And, not let them cloud my the following trading day.

I will also give myself some grace. Today was an incredibly small range for the afternoon and so a day not well suited for my system. I need to get better about evaluating the time of day (trend or range) and act or NOT ACT accordingly.

Key learning from today's red:

I aspire to get in exactly at support or resistance

Until then, as I wait for confirmation, it's crucial to size small and scale into positions

Level to level only! So what if it continues. Take profit and move on.

Today's stats. Too many trades. 5 trades. 2 wins. 2 losses. 1 green to small red.

I will scale into positions. I will size appropriately.

Comments