July 25

- Rishi Pahuja

- Jul 25, 2025

- 3 min read

I said yesterday:

Tomorrow I will be equally patient.

I will write out my justification here.

I will size smaller and let it play out.

And, Friday:

I need to write a paragraph justification for a trade which covers:

HTF directional probability with clear identification of support and resistance levels

10m interaction with ATR levels, what's therefore likely?

Where was previous support? Previous resistance? 70% retracement?

How would the 10m candle have to close to invalidate the direction?

And, have to accept the loss so that I can execute the plan clear headed

I wait until obvious and enter at CaSPar - actually easier at caspar than chasing!

Daily

Still ridiculously bullish

Potentially creating an evening star reversal? But that's predicting. Right now Wednesdays close and high acted as support yesterday. And, we're currently probing higher, albeit slowly.

4H

Overnight signaling for a mean reversion. Currently the swing 500 level is acting as clear resistance. But, the 8e acting as clear support. On SPX we have 4 dots into the firing of the squeeze and are currently pretty extended from the ribbon. While price can continue higher it would not be ideal for calls here.

Hourly

Having said that... The MD 386 hit. 80% chance of 6394 SPX by EOD.. Not much upside, but enough. We're currently running into resistance from yesterday. Ribbon is bullish and we're squeezing since yesterday morning.

Unfortunately, the hourly bias is very much bullish. Everything is bullish. Yet currently we're at resistance at PDH. I will wait for the range to break clearly and enter on momo or if no momo wait for a proper pullback. Otherwise I will wait for an M with divergence to signal a scalp down to 6375.

10m

Squeezing. Thin ribbon. Trying to get bullish expansion. Calls in the ribbon only. Ribbon currently acting as support. Typically a 10m21e entry is ideal for calls. If we reject PDH high again (ideally M with divergence, that'd be a signal to scalp down to the ribbon). Otherwise if we get a move into the 10m ribbon and holds, that's signal for calls (ideally W with divergence). Entering at CASPAR makes everything easier.

Explain it to ?

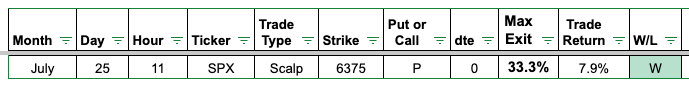

Everything is bullish. But we're not in the ribbon so entering calls not ideal. Plus we're at a clear resistance level. However, I can't help but think we're potentially creating an M with divergence?! I will wait. Got my M with divergence. And executed relatively close to support. I added as the position went in my favor but if I just held my original size and waited for my max exit the profit amount would've been roughly the same. Because it was a counter trend scalp I shouldn't have expected a large continuation. My exits were solid.

What I missed though was when I exited and why I exited was because we didn't vommy on the 3m. A failed vommy is just a bull flag breakout. The bias was always bullish. My put exits were actually the perfect place to enter calls. Of course calls were the bigger move.

That's two green weeks in a row. I haven't come back from the stupidity of three weeks ago, but that's in the past. And, we're focused on the most recent success and the process of fully writing my thoughts out, being totally content to miss unless a caspar entry presents itself. It always becomes obvious and it's easier to hold with a written thesis and proper entry.

Comments