July 22

- Rishi Pahuja

- Jul 22, 2025

- 5 min read

I said yesterday:

Tomorrow I will be equally patient.

I will write out my justification here.

I will size smaller and let it play out.

And, Friday:

I need to write a paragraph justification for a trade which covers:

HTF directional probability with clear identification of support and resistance levels

10m interaction with ATR levels, what's therefore likely?

Where was previous support? Previous resistance? 70% retracement?

How would the 10m candle have to close to invalidate the direction?

And, have to accept the loss so that I can execute the plan clear headed

Today:

Only with a solid AF style 10m based thesis can I accept the loss and feel confident holding til take profit level.

Daily

Still just consolidating between quarterly call and quarterly pivot on SPY. Ribbon is holding as support at the 8e.

4h

Swing call support. Bullish ribbon, but starting to eat into it with just the 21e holding on close. Momentum is declining and squeezing.

Hourly

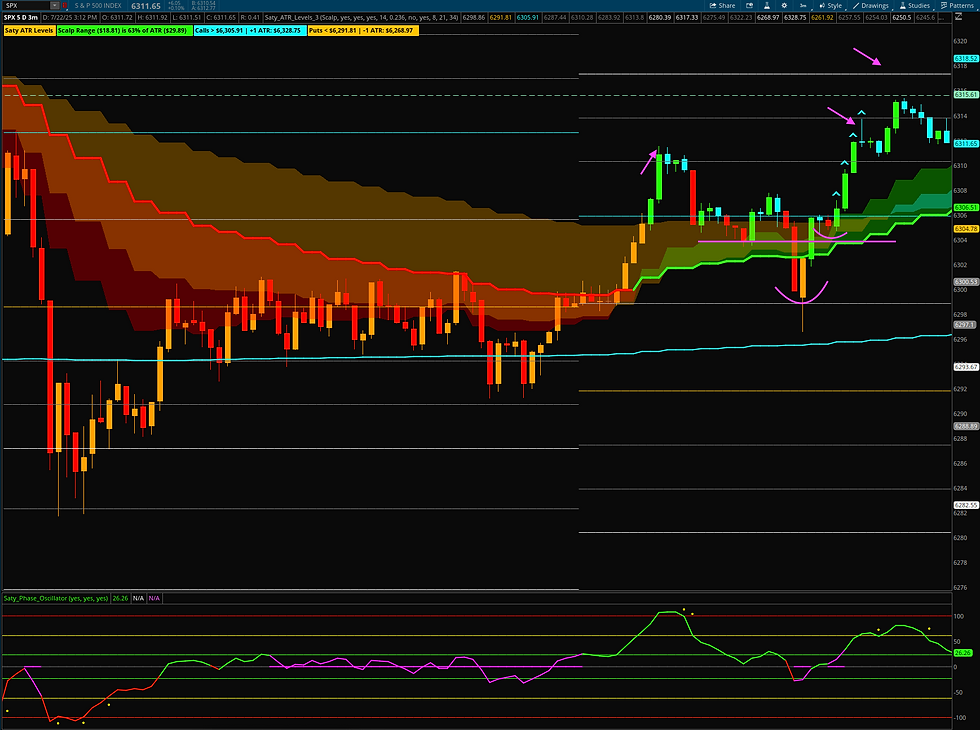

Clear bearish ribbon. Bearish structure. H21 currently resistance. Coinciding with the .705 level from this mornings sell off. Hourly divergence, mean reversion has played out. We're at the H21.

We've yet to hit either trigger with the PWC acting as a significant level.

On SPX, the H21 has flipped from support to resistance. But potentially flipping back this hour.

Daily and 4h are bullish but waning / consolidating / low momentum.

H is solidly bearish on SPY, in transition on SPX.

We're currently retracing 75%ish of the morning sell off. Resistance is all the way at the HOD. Most recent low is near the put trigger. We're currently at PDC and trying to close above the 10m200e. With the hourly bearish and the 10m.

Wow we just tapped HOD.

At this moment 130p, we are at resistance. Only puts can be considered here. Calls require a steep pullback to the flipping 10m ribbon. So, price is struggling to break the supply zone from this morning. Vix is extended also making a LL with EL PO.

Okay well huge rejection off of the resistance level. I didn't take it, nor chase it. I was waiting for another chance to enter closer to resistance. It didn't come, but doesn't mean it may still not come. Also, so what if I missed there will be another opportunity. I need to be wary of entering too early as that's usually what I do, ESPECIALLY, after feeling like I missed a trade I should've made.

Hmmm I'm trying to force something right now. And, I'm sizing too big given I'm going ITM. I'm walking away. I did not walk away.

But, it did finally become obvious.

I was positioned for puts. I wasn't confident in my puts. Puts went 100%. Then I bought the pullback only for it to be a clear pump fake for a rip higher. Fortunately I found my entry for calls and had the clarity to hold. Somehow green on the day. Albeit tiny, and maybe barely covering the trade fees, but green none the less.

First the trade I wanted to take, did and then panic sold because I sized too large, especially for ITM:

Ivommy right up into this mornings supply at the PDC. I wanted to take puts. Justification for puts. Hourly bias down. Wicked off prior supply zone and PDC. Very extended from the ribbon and the last support level. Tweezer top was extra confirmation. Enter!

But, fine, I missed it. Now what? We rejected at the supply zone. We confirmed resistance at the PDC. So where was previous support? Or 70% retracement from the swing low to the new swing high? Does it also happen to coincide with an ATR level? Yes. The put trigger.

Doesn't mean I had to buy the scary tank. But the long wick trapped late shorts. The candle itself held the 10m21e. The next candle confirmed the 10m21e was acting as support. And, that was the major trap move that caught late shorts. All the confirmation in the world to get long. Which I did. Plus...

Scalp levels SPX. The 382 hit. Meaning an 80% the 500 would hit and a 65% the 618 would hit. Once we tweezered off the scalp close level and regained the prior support just below the call trigger, there was every justification to hold until the 500 was hit. And, then runners to to 618 with an acceptable exit of the previous weeks high.

I entered calls at 6303 for $8. Exited at the 382 level of 6310 for 37.5%. More at the previous swing high at 6312 for 60%. And, finally a tad late on my exit at PWC close but runner at $15 for 88%.

The probabilities of the scalp levels allowed me to hold. If anything I had the justification to hold the entire position til the 500 level, but because I was in a drawdown from the earlier overtrading I was quick to take profit.

What's really painful and got me in more trouble..

I was in the 6310 puts for $6.5. The low was only $6.1 but I was not confident. And, because of the size went ahead and exited just to get out of the trade. 1. Not the worst thing. A great job of adhering to 'when in doubt, get out.' Of course after I exited I wanted to re-enter. And, thought about just grabbing 1 or 2 cons. But, for some reason I don't allow myself to buy a few cons.

I know it would make it so easy to hold through the wiggles. But, it's as if I'm scared to be right and not make the most of 'being right' But in reality that just exposing me to losing big when I'm wrong. Because it has nothing to do with me being right or wrong. Rather how the probabilities play out.

Anyway I thought about entering 2 cons around $7. They immediately shot to $15. Even two cons was enough to make a real return. With 0dte I don't need size! Quit sizing up. Of course I bought those same cons back thinking we were pulling back for more downside. I bought them for way more and sold them for my original entry.

So, again if I was willing to lose that much, I may as well of held and suffered the original drawdown because that was the move! I have to, have to, have to accept the loss. And, that really only comes from truly believing in the setup. And, that only comes from being crazy patient. If I didn't trade at all and just took my final trade only, which came well after it was obvious. Then I'd be low stress big green. Instead I'm barely green.

But green is green!

0dte does not require size. Stop sizing.

As always it's pretty simply. Clear reversal given the ivommy. We broke and held the PDC level. So, now we need to go retest previous support --> The put trigger... So simple.

Comments