July 14

- Rishi Pahuja

- Jul 14, 2025

- 2 min read

I am a patient and process oriented trader.

Daily Chart

Bullish. 8e acting as support. We did put in a lower PO with a new ATH on Friday. But very small divergence. As long as the 8e continues to hold there's no reason to play for a mean reversion too soon.

4h Chart

Bullish. 48e and previous support continued to hold as support. Wedge breakout in progress. Though approaching Friday resistance. Squeezing with momo currently rising. SPX 4h 13e clear last line of support - 6240ish

Hourly

Slow and steady move up today. Squeezing but approaching Friday resistance. SPY showing PO in distribution zone. No squeeze on hourly to suggest more is likely. And again we're currently at resistance... not the place to get long!

10m Plan

In the trigger box with a bullish bias. Supports are PDC, Put trigger, PDL, and -618. PDH and Call trigger above. So far putting in an inside day. Tomorrow morning is CPI so consolidation ahead of that print perhaps?

While there's trend on SPY, we're in transition on SPX. We're clearly moving up so calls at support (PDC or 10m21e) or Puts at resistance if the 10m creates a resistance level.

I will defer to the upside. Which means waiting until a clear entry in the ribbon. Or wait until a 10m reversal pattern emerges. Even then the move would only be to the 10m21e and could be very choppy given the trend is up.

----

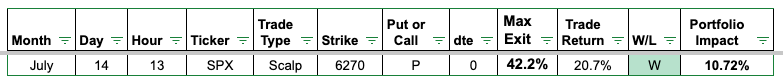

It's not that a crystal clear reversal pattern emerged on the 10m. It's that we were at clear resistance. Previous day high and call trigger. 10m was showing divergence on SPY, not on SPX. Vix had divergence though. A lower value with equal PO. So I was on the lookout for puts but only at resistance. The 1m breached the previous high, but stalled at the call trigger and put in a significantly lower PO. The premium chart was putting in a LL with HL PO. Multiple confluences to enter puts. My stop loss was a close above the previous high which would've been a stop loss of around $3.5 or 24% off my entry of $4.5. The expert thing to do once entered was wait to exit at the 3m21e or cut at the stop level. Premiums reached $6.5 at the 3m21e in SPY/SPX and the premium chart. 44% gain.

Started with the 10m.

Tweezer Top off the call trigger and previous day high. BUT bullish ribbon. Wait to see how price reacts at resistance. Price moved back higher but with no volume and immediately rejected. 3m chart formed an evening star reversal. Enter!

Scale out and ultimately exit at 3m21.

Solid trade. Price really wasn't moving. Momentum slow. Direction slightly up, but mostly sideways. Smart to just take the 4 points. High confidence trade with size only requires 4 points to move the needle. However, the better trade is waiting for real movement so that gains are larger relative to the risk being taken on. Just requires patience.

Comments