August 5th

- Rishi Pahuja

- Aug 5, 2025

- 5 min read

THIS WEEK...

I don't know what to say, other than I've been here before and have negated it before with over confidence. I will stay humble. I will focus on my process. I will wait until obvious. I will stay patient. I will scale in slowly as I'm always early. And, add as conviction grows. Or, cut because losses happen and the only thing that can derail me are large losses.

My mindset was my super power this week. I was resilient. I accepted the losses. I waited until a defensible and well articulated setup presented itself, and then waited until the right caspar entry.

I will be patient. I will resist fomo. There's no point. I didn't miss anything.

But, I feel like I read the PA perfect yesterday. What I thought would play out is playing out. An inability to break above " On SPX it's an equally important level. Previous monthly close, the 4h 21e." Then tank. Potentially consider longer term swings for the downside. Yesterday was a trap move up slash just a 70% retracement before continuing the downward move.

Daily

Quarterly Call trigger is resistance! Currently testing the Daily 21 now. If I'm predicting... I could see us put in a doji today and further downside tomorrow, maybe after a trap move up. I will react to price though, not react. We're still squeezing with downward momentum. Yesterday's move up was on relatively low volume. Having said all that... the ribbon and structure is still bullish. This is simply a necessary pullback- until it's something more.

4h

Previous month close held as resistance. And, is now new supply for our continued move down. We have another hour before this mornings candle closes, so we will wait and see. If we do close below the 48e, that would be a significant sign to take longer term puts to swing. Still waiting to see if we break the 48e on the 4h. Time will tell.

Hourly

On SPY we just pulled back to test the 48e and rejected hard. Though have yet to break morning support as of yet. If support continues to hold that may be a chance to consider a counter trend scalp back up to the ribbon. Squeeze is starting to fire which could signal continuation down. On Spx the hourly bias looks like its shifting red. Though again we're closer to support than resistance. Counter trend calls, or wait for a break of support to enter puts. The MD 618 is still the higher probability play for EOW.

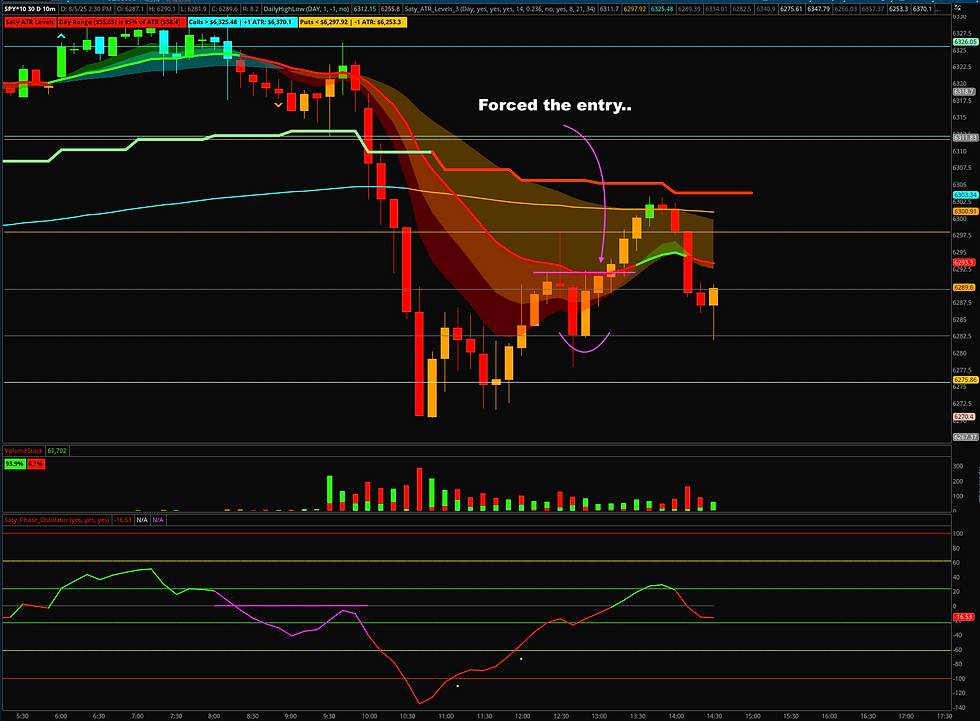

10m

Very bearish. 21e below the 200e. We already put in a mean reversion. Ribbon is clear resistance. Demand zone from this morning is starting to hold though. So we could see another move up to the ribbon before dropping at resistance, or a break out above. On SPX we lost the 618 this morning, but since then it has acted as very clear support, and now the 500 is acting as support.

I am waiting until extremely obvious. The hourly ribbon is trying to vommy and the 10m is clear resistance. Puts unless at or near the LOD. Patience. Obvious. Scale in regardless. Accept the loss.

VIX could be putting in a vommy. Close below the 48 may signal more upside. But I'd want the SPX 10/200 to break or put trigger before really being convinced of upside. Depending on how we close this may actually be a great area to short.

Not patient enough. I wanted to get short so I found reasons to, as opposed to potentially missing the move and just waiting waiting waiting for it to become obvious. Which, it of course did.

Trade 1

First the positives. Sized small and exited with an acceptable loss.

Bearish ribbon. I was looking to short. We found support at the 500 level. Plan was to short if the 21e held as resistance. It did, but created a tweezer bottom and higher low. The next candle also closed below the 21e, BUT ultimately held the 8e. We were starting to eat into the ribbon. We were in transition. Continuation up would signal a likely move to the 48e or we'd have lost the 8e.

In retrospect I was trying to short simply because we were at previous resistance. However, I needed a setup as well. The setup that was actually indicated was an ivommy with a move higher more likely.

I exited once we closed above the 21e.

Trade 2

Positive. I took my stop prudently.

Again, I was looking for an excuse to short. This time as price resisted the previous resistance and put trigger, I used that as reason enough to enter. However, the previous 4 10m candles showed a clear stair step up with no clear signs of a reversal.

Larger loss given the size. I need to cut that shit out.

Trade 3

The higher we went the more convinced I was we were heading down. Yet, I still entered too early, but had more confidence in the move and averaged down. It would've been better and easier to simply take the loss and then enter again as I had been doing, but I sized too large. The lesson is to scale scale scale each and every trade consistently.

This time we actually put in the beginnings of a reversal. We lost price momentum into the 200e and H21. We finally had a closing red candle. That was the early signs of a reversal.

Zooming into the 3m actual presented the reversal setup. M with divergence! That is when I averaged down more. But, as I continue to know and learn. When I oversize I am quick to profit and abandon the original thesis. The thesis being that if and when we reverse the likely target down is the previous swing low right at the 500 level, then the 618 level and then LOD.

Thoughts for tomorrow

Given my size I was all out by the 382. I didn't hold the huge size, I wouldn't hold the huge size. But, if I did....

I won't focus on that though because there will be many more opportunities and all I can do is focus on my process and execution and let the outcome be the outcome.

Really difficult day, but ultimately green. I'm not terrible proud of it because I took on far too much risk. I don't like that I'm suffering large drawdowns before then exiting quickly near break even. It's not the right mindset. And, it will not work more often than it does.

I think I got away from being present and mindful about what I was doing. The outcome will be the outcome. I can control my process and execution.

What I missed from my process is the written thesis and justification as if I was teaching someone. What are the factor for my entry. Writing it down is what makes it clearer. I have to write the thesis.

Comments