August 25

- Rishi Pahuja

- Aug 25, 2025

- 4 min read

10 days removed from trading. 12 days removed from a really tough day. I will not trade today.

In re-reading my posts since August 1, the major takeaways:

Resilience. I already covered it but it really resonated again this past week. Confidence allows for clearer execution. Yes, confidence comes from past success. But, on a micro basis, confidence comes from believing in the ability to come back from any outcome. In golf, the confidence to execute is shot is 1. practice 2. knowing that regardless of outcome I can scramble. Trading confidence comes from repetition, but also sizing in a way that allows for lasses.

Probabilities. In my best run the win rate was 80%. I have to assume and size always for the 20% outcome. Losses are part of the game. Size for a loss to add to the confidence in the ability to recover from it with the 80% of wins.

Analysis not prediction. What has happened in the last 6ish 10m candles? Are we eating into the ribbon? Is there a reversal pattern? If not, what has happened is more likely to continue to happen.

Scale. It's not about being right. It's about being wrong small.

Entering is not about fomo or chasing profit, it's about accepting the risk by focusing on how much I will lose if a 20% outcome emerges.

So often I feel like I'm going to miss it and I hate that I'm going to miss a thesis I see playing out. The flip is not that I may miss it, it's if the edge is present, what's the appropriate size to see which outcome plays out.

Writing out and slowly explaining a thesis is the only way to have the conviction in the edge to test the probabilities.

What is happening? What is more likely to happen? No predicting.

We don’t control what happens, we control how we respond to what happens.

How am I going to act depending on varying scenarios?

Daily + Quarterly ATR

We continue to be bullish AF. We have two really meaningfully open bull gaps. The previous quarter close has acted as support the last 3 tests. And, just last week we had a bear trapping pullback to the D21, Quarterly call trigger and TL support with a major volume push off on Friday. On SPY at least the 500 has tapped which means the 618 has an almost 80% of hitting by the end of September. Especially, given we've only travelled 55% of the quarterly ATR. The question as always will be how far the pullback will be before the 618 is hit. Something to note... the last two highs have come with lower PO values. We are currently lower now, but that's irrelevant until topping candles emerge. If I were to trade the daily. I'd consider calls only, but the risk reward is skewed given the distance from the ribbon. We can absolutely continue higher from here, but the better risk reward is a call entry in the ribbon. I would look to see if/when the 382 and 21e coincide and how price responds.

4h + Monthly ATR

Also bullish AF. The end of the previous (not last week) signaled a mean reversion with divergence. An M double top, lower PO and PO dot signaling a likely move down last week. Once we lost support, it turned to resistance and we moved down to the 21, then continued down to test the previous month close. 4 tests and the 48e held as support without a lower push down below the previous month high. It's easy in hindsight to see the wedge/flag and rip, but without the huge shrek candle, it would seem like a vommy forming. From a setup standpoint there was no clear trigger for the vommy (a break of the 48e). The ribbon and structure was still bullish. And, no lower lows were made. All justification to only consider long with a stop loss of a close below the 48e or previous month close. Last Friday we once again tapped the 382 triggering a more probable run to the 500 by end of month. While we could continue from here, the best risk reward is an entry with multiple confirmations of support in the ribbon or at the call trigger. We are simply flagging right now. If we do fail to break the 382 I could see another move down to the 21e. SPY is showing the same situation but in the overnight and premarket we already started to find support at the 8e. More chop or drop needed for the SPX ribbon to catch up.

Hourly + Weekly ATR

Also very bullish. Though we're struggling with trying to break above Friday's high and close and are primed for a mean reversion, if not deeper to the MD put trigger and previous month high. While ribbon and structure are bullish we are far from the previous swing low and need to flag for longer to make up for the powerful move on Friday.

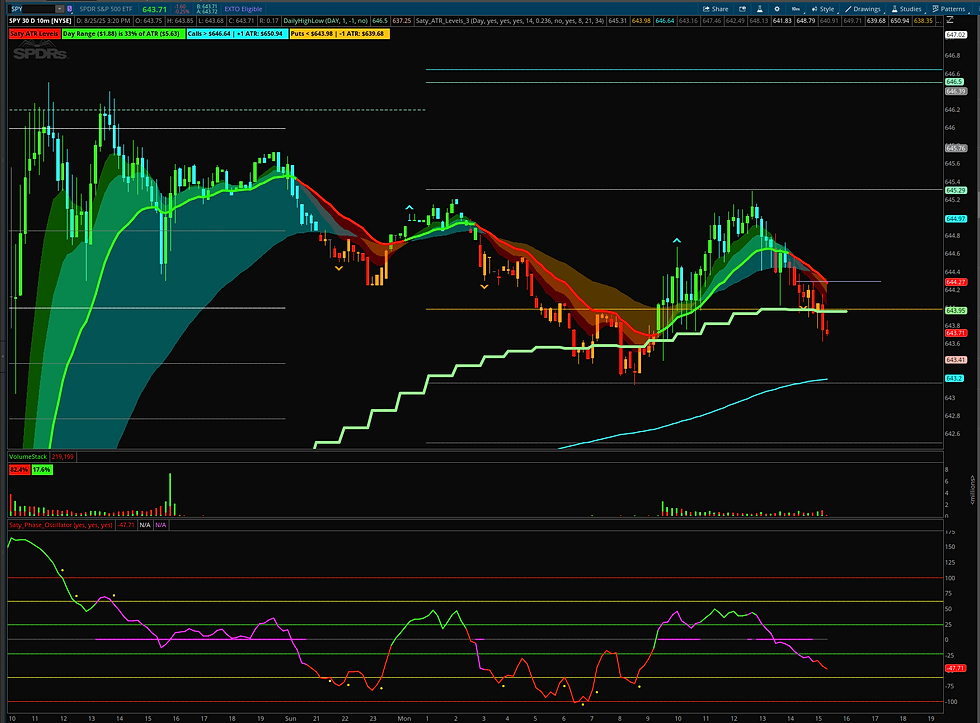

Last 6 10m + Daily ATR

Choppy. Choppy. Choppy. We're flagging after Friday's large move. 1230p we perfectly rejected PDC. Then we continually rejected the 8e testing the put trigger. Since then the 8e has continually acted as resistance. The 240p and 3p candle were trappy 'hammers' that failed to exceed the previous candles high nor the 8e. Plenty of justification to get short or stay short. On the 10m time frame the next level down is the 382 and premarket low. But, we're nearing EOD so best to take profit.

Sizing small. Sizing for the loss. Makes trading easier. 5 cons on a proper setup moves the needle. Do that over and over it's all it takes.

Comments