August 14

- Rishi Pahuja

- Aug 14, 2025

- 6 min read

Updated: Aug 25, 2025

I am excited to run my process. Yes, it's tedious but it makes trade execution so much calmer and effective.

Yesterday, I wish that as I was being very aware of the 10m21e consistently holding for 40+ mins - and the lack of a reversal pattern - I wish that I was unafraid to buy the dips below and hold until my TP level was it. The TP eventually hit perfectly. I did enter, but I wasn't confident enough to hold the position until then. I also was not confident in getting in at the scary dip, despite being very aware that the 21e consistently held. Yes we were at resistance so extra caution was warranted, BUT, the ribbon was holding. That's what was happening. In the absence of a clear reversal pattern, I should continue to expect support to hold. And, if it doesn't, because it may not, then I've sized appropriately, take the loss, and move on.

What is happening? What is more likely to happen? No predicting.

We don’t control what happens, we control how we respond to what happens.

How am I going to act depending on varying scenarios?

I read something about golf yesterday and think it perfectly mirrors the mindset required for trading.

Real confidence in golf isn’t built by perfection.

It’s built by knowing you can handle the bad shots.

That’s the paradox: Confidence = Recovery

Golf is a game of managing variance.

Bad shots, bad bounces, bad breaks - these aren’t signs of failure. They’re part of the deal.

Expect them. Prepare for them.

I’ve had plenty of rounds where things didn't go according to plan, and I still scored well.

Why?

I stayed patient, made smart decisions, and avoided compounding mistakes.

Confidence in trading isn't perfection. It's knowing that by following the process the wins will outweigh the losses. Trading is about risk management. Losses happen. Even in my best stretch my win rate was 82%. I must expect and prepare and size for the 18%. I can profit with losses by staying patient, sticking to the process and never averaging down.

Daily / Quarterly ATR

Slightly extended from the ribbon. Yesterday we put in a star. So, we could very well be putting in the start of an evening star reversal. So far today the PDH has not been tested, PDL was and held. The ribbon is still incredibly bullish so it makes sense we haven't flushed. Daily squeeze may be starting to fire. Yesterday the high coincided with the quarterly 500 level. Tuesday we sucessfully broke and held the 382 and we'd typically want a retest of that level and/or the ribbon before expect a move up to the 618.

4h / Swing ATR

Ribbon very bullish. Swing call trigger is clear support with the 382 as resistance. Yesterday we briefly breached the 382 and have since tested the 21e and call trigger which acted as support this morning. On SPX, similar ribbon and bullishness. But, we are extended from the ribbon with 6450 acting as meaningful resistance turned support over the last 4 days. If this is a top then we are creating a HH with divergence and a deeper pullback may be warranted. If we close below yesterdays support that may signal more downside to come. But, the control is squarely with the bulls.

Hourly / Weekly ATR

Thinning ribbon.. The 8a hourly candle tanked from above the ribbon down to just below the 48e. We have since tested levels higher than the selloff but not higher than PDH. And, IF we were to close below the 10a hourly high we'd likely create a bearish engulfing candle with lower high. I will wait to see how price closes relative to the 48e. SPX is a bit more bullish. The H13 held at open. And, we're currently testing it again now. This is also yesterdays low. We are currently at support. IF it were to break, 6435 would be up first, and then 6415, and 6400. If it holds I think 6465 and then 6480.

Last 6 10m / Daily ART

1050a candle put in a very clear and convincing bearish engulfing candle. We continued down trying to hold the 13e until 1120 when we tanked below the 48, below the 200 and below the put trigger. We are currently bouncing near PDL and former resistance turned support from the mornings reversal. Ps. The bearish engulfing signaled a top with divergence, hence further downside was likely. On SPX the put trigger has also just been lost. The opening 10m candle breaked the -382 and PDL signaling high probabilities of downside to at least the -500 and then -618. The 48e was lost. The put trigger was lost. Those could be clear risk levels for entering puts. But, perhaps another move higher, a lower high is put in first. I don't love the idea of getting short here and HTF support.

10m Plan

Currently at support. Maybe a W off the 3m. Shorts require a swing high / LH near PDC. A loss of the 382 can signal more downside to premarket low. An M with divergence.

I will wait until stupid obvious. If I'm in doubt, I will stay out.

The bias is very much still up untess/until the hourly 48 is lost on SPY or the 21 on SPX.

Put trigger lost and continues to act as resistance. Wicks up to the ribbon and 200e are sellable. But we're so close to support there's not much room down, nor an expectation of a break. If previous candle high and ribbon hold as resistance, that's a potential sign to get short until down the the current low - no continuation expected.

I'm currently wanting to enter long because we do have the 3m W. But I'm just going to wait. If we get a dip below the most recent low and a wick back up that is a signal to get long for a scalp up the the 3m21e. That requires waiting for the dip below and wick. If it breaks down, then I wait for a pullback entry for puts.

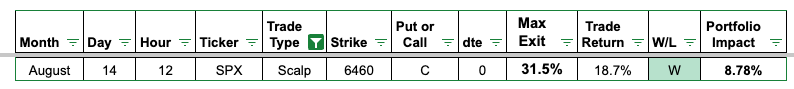

Trade 1

Plan worked. We were at support. The 10m started to form the first two candles of a morning star reversal off support. The higher time frame was bullish. Calls at support was the right mentality.

We were clearly at support. HTF bullish. Two candles unable to continue any lower.

Now the confirmation? The 3m retest of the support. We weren't able to dip below the previous swing low. We kept basing at support. That was the entry for long back to the 10m ribbon - 10m21e.

I still had to make the decision to enter. I didn't enter right at support. I was waiting for a dip and wick higher. We held the previous low and started basing. When we started running 'without me' my mindset was oh I'm going to miss it. But, the thought that allowed me to take the trade... I shouldn't be thinking of I'm going to miss it. It's how much am I willing to lose if I'm wrong?

How much am I willing to lose if I'm wrong. I felt confident about the setup. And, it wasn't until I thought about the trade in terms of loss acceptance that I finally pulled the trigger.

Additionally, rather than panic selling quickly to take profit, I waited. I was in profit, price was responding the probable way, why cut it early? I had accepted the loss. I knew I could be wrong. But, if I was right I was willing to wait for exits.

That doesn't mean I didn't scale plenty early, but I did wait and I held more longer.

The process of writing was amazing and helpful. It gave me the confidence in my analysis. The confidence in my trade execution only came after I thought in terms of loss.

Written analysis focusing on trend, PO, ATR levels and probabilities.

Wait until a stupid obvious setup on the 10m - then zoom in to confirm

Identify CaSPar

Check if premium is squeezing with divergence

How much are you willing to lose if wrong?

Where is the stop loss? Why? What % of the port are you willing to risk?

Scale in

Great day.

Comments