April 30 Recap

- Rishi Pahuja

- Apr 30, 2025

- 5 min read

Trade 1

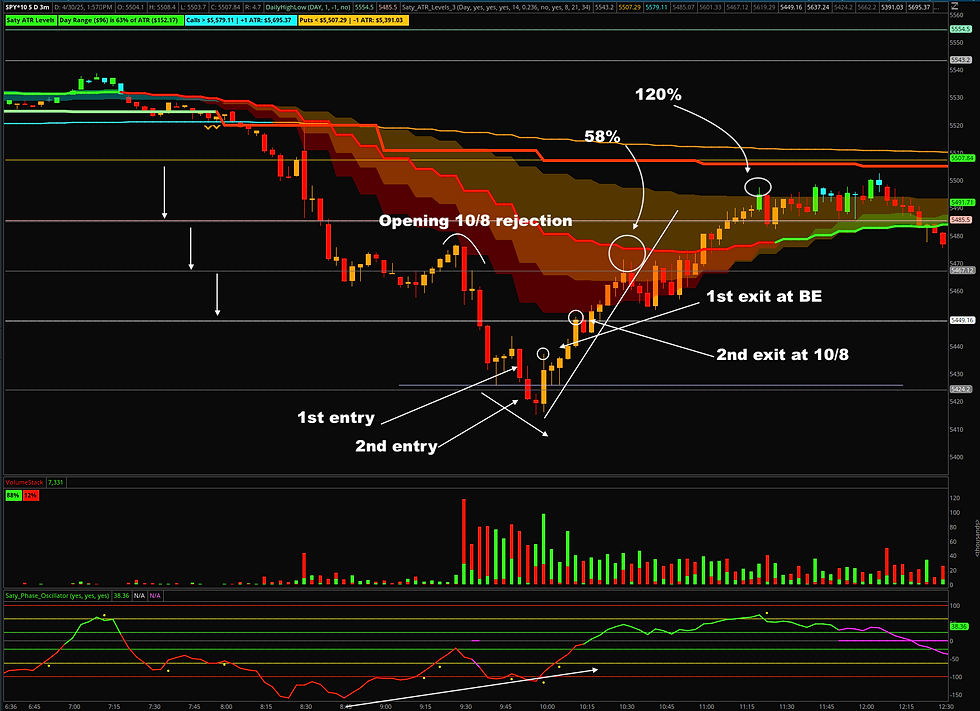

This morning I wrote "Base case is a quick reversion back to the 10m ribbon. We can scalp calls up."

I was eventually right on this, but it took a great deal of patience and conviction to capitalize on it. Right at open we tanked off the 10/8. There was certainly justification for getting short with the high probability of price reaching the -618 level. However, we were so extended on multiple time frames that the risk reward for puts wasn't there. It's incredibly hard to fully believe that when I watch puts gain 30-40% from where I decide it's too late to get in, but that was my plan this morning. I followed it.

As the market opened we did in fact hit the -618 and then some. Because we were so extended I was looking for some support to consider taking calls as a scalp. As I've learned, we rarely find support and just reverse from there. We typically find support, rip away only to test again, and more often than not breach below - where retail is typically keeping their stops - then ripping. The best way to identify when a move lower is just a stop raid, is if there's a divergence created on the stochastic. In this case we made a move lower in price, but with increasing momentum.

Because I'm still an amateur, and cave to 'missing' the trade, I scaled in early. Despite mentioning how rare it is to reverse without multiple tests or breach of lows, I scaled in just in case, with the plan to add either below existing support, or after a reversal is confirmed.

Of course we breached the low and so I entered moret almost 15% below my original entry. I was okay doing this because we were actually closer to the stop level, so it was actually less risky entering there. But, because I was immediately 'down' on the trade I didn't hold as long as I would've liked. Instead I exited the first con at break even, allowing the second contract to run to the target. The return on the second contract was 27%. Return on the trade if I held both to the 2nd exit, 15.6% vs. 11%. All good.

Of course, if I held the trade to the 10/21 or 10/48, the 2nd tranche would've return 58% 120% respectively. As I will continue to remind myself every day, my goal is not to enter at the bottom and exit at the top, rather grab a slice when the probabilities are in my favor and move on to the next trade.

Trade 2

This is one of my most proud trades. I had a thesis, I resisted the urge chase in as it was running without me, I avoided the temptation to flip bias when price moved against me, holding firm to my thesis, and entering at a far more favorable point - and after all that, exiting at the next level- which turned out to be a great exit given the insane rip right after I got out.

The bias from the get go was downside, the 10m still showing downside structure, and price was struggling to meaningfully break the 10/48. Zooming into the 3m, I saw clear divergence forming, but was content to wait for a break below the 3/21 before capitalizing on the divergence. This is where my patience was tested. We continue to just bleed out and the contracts I was looking at rose 20-30% over that time.

I maintained discipline. I enter puts at resistance. We were never at resistance again, the move was too quick and too strong. Interestingly enough everytime I mentally caved, and felt it was going to tank without me, that's when price started to revert. We got the rip back up, which validated my relucatance to enter puts for continuation.

As we ripped and broke above the 3/21, I started entertaining the idea of calls. Even more so as we recapture the 10/48... However, I noticed that we weren't able to create a higher high on the 3m chart. Until we did so I couldn't contemplate calls, and had to defer to my original thesis of down.

Besides an entry to calls would be at the 3/21, so let's see how price reacts there. Price dropped and closed below the 3/21 which confirmed my entry and became my stop loss.

I wasn't as come as I would've liked entering the trade, and so I took a few exits way too early. My last contact I held until the previous low. Part of me thought we would break below and continue on to retest the LOD, and so I was hesitant. But as an aspiring professional I have to just adhere to the plan - level to level - stack wins and build consistence and confidence.

Really solid day. Two high confidence trades, with pretty good execution. Now I'll wait until EOD for a setup. As I mentioned this morning the last days of the month tend to end the day with explosive moves, so I will save my mental capital for then. Old me would take this 2/2 day and continue to trade, and more likely than not turn a green day to red. I've learned the hard way to stay content and save my energy for the next day. High quality trades only.

EOD Trade

Remember I don't 'count' the EOD trades when I'm evaluating my win rate, because I'm taking a extra high full risk trades with a small portion of profits that I fully expect to go to zero. Why do I do this? Well today I was essentially waiting all day for end of day, because I've noticed that the last 30 minutes on the last day of the month are always explosive.

Here was the chart heading into the last 20 minutes...

Starting off the 1:12pm (where I exited my puts) we started an aggressive move up and spent the next 90 minutes ranging between the scalp call trigger and the scalp close. Given the bullish momentum and the bull flag, any entry into calls at support (scalp close) were ideal. The engulfing off the scalp close with the squeeze was incredible justification to enter calls with an expectation to exit at the scalp call trigger 5535, or the previous local high at 5546.

I was looking at the 5530 calls, which dipped to 2.35 before the bullish engulfing. The next candle saw a low of $3 aka within the allowed loss given the profit on the day. I was in the middle of something else and content to wait for another entry.

Then, the explosion...

Not only did we hit the call trigger, we hit the local high, and then continued to rip. These moves happen at the end of the month, and if you're well positioned with full acceptance of the loss massive moves can happen. The 5530 calls were trading $2.35 to $5 with a 'likely' entry of $3. They hit $14 at the call trigger, $22 at the previous high, closed at 38 at the scalp 618 level and tapped $52 as it broke yesterdays high (green line at 5572). $3 to $52.

As it ran away from me there really wasn't a good setup or proper risk reward entry. In the last 90 seconds I took a flier for $.90 expecting a continued push higher, but it didn't work out.

I will be even more ready next End of Month.

2 for 2 on day trades. 0 for 1 EOD - risking only a very small percentage of the profit from the day. Success!

Comments