April 21, 2025 Recap

- Rishi Pahuja

- Apr 21, 2025

- 4 min read

Trade 1

It required a lot of patience for price to get back into the 10m ribbon. As is typical, once it started piercing the ribbon, I briefly thought about the start of a reversal. BUT, my system is not about predicting price, it's about deferring to the probabilities and the plan.

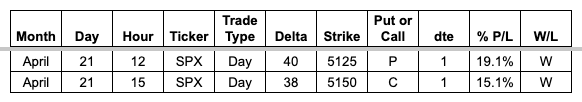

The bias was down. It was a matter of waiting for the right entry. Price broke the -786 level at 11:30 and retested it at 12:39. I entered puts given the 10/13 was holding as resistance, the 3/48 was holding as resistance and the -786. I enter puts at resistance, to minimize the loss if it were to reverse.

The technical stop was set at a 3m close above the 3/48. Sizing was such that even a huge move against would've kept me within the R value.

1st planned exit was the 3m bounce point at 5132. 2nd planned exit is previous LOD. And, expected target was a dip below the previous 4h low made on April 10th at 5115. System based target was -1 ATR at 5110. Key psych level from there 5100.

I exited in full with 19% profit at the first take profit level. More that content with that given 1dte (0dte I'm typically ~40%). This is something I need to work on, which is to set a breakeven stop and be okay with the stop hitting, or my later targets hitting. At that point there is no way to lose. On the flip side, there have been too many times I've wanted more from a trade only for it to reverse and become a loss.

While I may have exited early, it's better to be in annoyed in profit, that annoyed in loss.

If I waited until previous LOD: 32.6% --- 10 minutes of chop

If I waited until previous 4h lo: 55.8%

If I waited until -1 ATR: 55.8%

If I waited until 5100: 68%

Having said all that, today's trade was slowly and calmly entered. A real understanding of the loss potential was engrained before taking the trade. A focus on stacking wins was paramount, hence I'm content 'paper handing'.

Trade 2? I hesitated and didn't take it.

Same thesis, same situation. 2 hours later, price breached into the ribbon. Saw a hard reject off the 10/13 confirmed after 3, 3m candles. And, I didn't enter puts. Why not? Well we've already moved 1ATR so the R/R was low. And, there was actual divergence showing on the 10m chart. Which opens the door for a reversion to the 10/21 before continuation. Additionally we are extended on the hourly. Likely target was only previous LOD so I just didn't want to take the risk. Of course when it starts to head down there I start beating myself up for not taking it- even if it means entering late. BUT, I'd rather miss it, than once again not adhere to entering Puts at Resistance. When I ignore that requirement, while it could work, it does open myself to a greater drawdown. Best to just wait until the next opportunity, because there always is one!

Trade 2!

So just above I hesitated and was annoyed I didn't enter puts. It was still a good put entry, but interesting we didn't breach the LOD. Instead, we created a higher low on the 3m, and the 10m closed in the ribbon after failing to break the low. This close on the 10m also came with divergence on the 10m. We had three drives lower and couldn't move the third time. This was a signal to look long.

Once the 3/21 flipped from resistance to support I looked for my entry. However, I was extremely reluctant to do so given the 10m was clearly down. However, we had a clear setup and so entered calls at 5116. We reached the next scalp level of 5128 before tanking back down to my entry. I hadn't exited at the level, and so was quick to exit once we got to the level again.

However, instinctually, the fact we didn't lose support confirmed the 3m reversal and a further push into the 10m ribbon. I sold at 15.1% profit, with the trade, never breaking below my sell point on it's way to the next scalp level which would've netter 63.3%

My short term goal however is to be more consistent, taking smaller wins, and worrying about maximizing each trade in the long run. Stacking wins compounds and that's what I'm focused on.

Trade 1 - great entry, early exit, profit!

Trade 2 - solid entry, early exit, profit!

Interestingly enough, while I was in the 2nd trade. I noticed that the contract had a max volume of ~40 contracts in every 3m period. Once I entered we had back to back candles of 200 and 400 contracts. This could mean that bigger players were expecting a move up and could've given more confidence to hold longer. Something to note going forward.

Comments